What is the ECS Mandate?

A service provided by banks called ECS, or Electronic Clearing Service, automates monthly transactions. It facilitates automatic money transfers from one bank account to another on a specified due date. It is typically used to make fixed payments for interest, salary, pension, EMI, or utility costs. ECS is quite helpful for people who have chosen to take out a loan or who have automatic monthly credit card payments.

ECS Means that the lender financial company can easily set up a monthly deduction and won’t have to keep track of the precise payment date. Electronic Clearing Service is the full name of ECS in banking.

How to Complete the e-Mandate Registration Process for the Insta EMI Card?

You must first inform your bank in order to use an ECS mandate. Your bank account information and that of your branch are included in the ECS mandate. They can limit the most that can be taken from an ECS user’s account. A signed ECS mandate, basic KYC information, and a cancelled check are required when making an easy EMI purchase on the Bajaj Finserv EMI Network.

How to log in to the customer portal to check EMI Network Card details?

You must sign in to the customer portal, Experia, either with an OTP given to your registered mobile number or your customer ID and password to access the information associated with your EMI Network Card login. In the “My Relations” area, after logging in, you may see the information about your EMI Network Card.

How to Avail ECS Mandate?

Get in touch with your bank and do the subsequent actions to set up an ECS mandate:

- The bank will provide a properly filled-out ECS mandate form. According to the form, you have given the bank permission to make debit or credit deductions for ECS.

- The ECS mandate form will contain all necessary information regarding the bank account, name, etc. A properly completed and signed ECS mandate form is the actual authorisation document.

- The maximum amount that can be deducted from the account is another choice. No deduction would ever be made that was greater than the maximum allowed.

- The bank will send you an SMS with all the transaction data following each transaction.

How Does ECS Function?

The ECS mandate form, which authorises the bank to deduct a specific amount each month from your bank account, is something the bank asks you to sign when you apply for a loan or credit card. The ECS mandate also mentions the debit timeline. Additionally, the customer can renounce the mandate and end ECS anytime. In a nutshell, an ECS mandate permits and authorises the clearing house and the bank to make a specific monthly deduction on a predetermined date. The National Payment Corporation of India runs the clearing house known as NACH or the National Automated clearing house. Many large firms use NACH because of its improved security features, sophisticated dispute systems, and speed, although ECS has a wider reach and more connections.

The RBI and the National Payments Corporation of India introduced the E-Mandate digital payment service to simplify the payment procedure for businesses. This procedure acts as the fundamental framework for businesses’ automated payment collection. This requirement was previously available offline, but the online process has made it more practical. After learning an e-Mandate, continue reading to learn more about how this procedure works.

How to register for Bajaj Finserv e-Mandate?

- Step 1: Access the Bajaj Finserv Customer Portal.

- Step 2: Choose the e-Mandate option.

- Step 3: Review all personal information and select “continue.”

- Step 4: Verify your bank account information, choose your preferred registration mode, review the disclaimers, and click the “submit” button.

- Step 5: If you use the OTP option, enter the code sent to your registered cell phone number and click “Submit.”

If you choose the “debit card/net banking” option, you will be taken to the “Digio Page.” You can read the disclaimer, select your registration method, and then submit the form. Digio is a recognised NPCI-accredited aggregator of the e-Mandate procedure.

- Step 6: You will be sent to your chosen bank’s website once you have finished either of the aforementioned procedures.

- Using net banking: on the bank’s website, enter your login information and OTP to confirm your Bajaj Finserv e-Mandate.

- Using a debit card: Visit the bank’s website and enter your debit card information and OTP to finish the Bajaj Finserv e-Mandate online with a debit card.

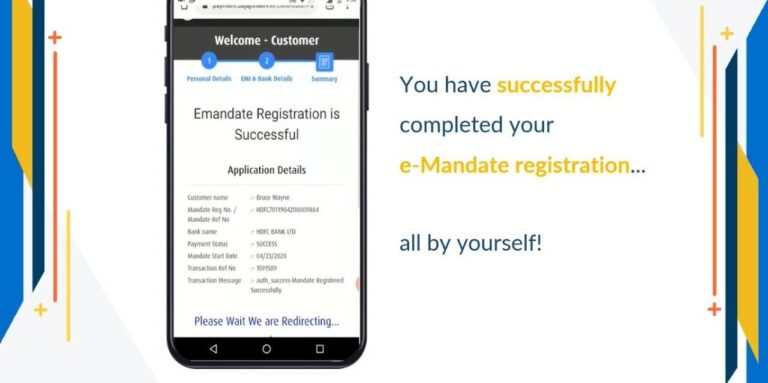

- Step 7: Once this mandate has been successfully authenticated, your bank will promptly authorise it.

Your application will be registered with your respective banks once you’ve finished the stages mentioned above. After that, in your Bajaj Finserv account, you may view the Bajaj Finserv e-Mandate status. Additionally, you should be aware that you are free to revoke this order at any time. To finish this process, all you have to do is contact your bank. On the other hand, a company can also cancel it if necessary by sending paperwork to the appropriate banks.